5.1 Rate of Return

Companies typically invest in projects to generate income. The rate of return is the profit from an investment divided by the initial investment, typically expressed as a percentage. For example, if you buy a $1.00 lottery ticket and win $10.00 (yielding a profit of $9.00), then your rate of return would be $9.00/$1.00 = 900%.

Often, people making investment decisions require a minimum rate of return to justify making the investment. Formally, this threshold or benchmark is called the MARR (minimum acceptable rate of return). Typically, a MARR would only be set by a business; however, an individual could also effectively have a MARR for their personal investments. For example, if you have a savings account that generates 1.5% interest, you might say that your personal MARR is 1.5%, because you would not invest in any projects that would earn you less than keeping your money in that account.

In a given situation, the MARR is chosen based on several factors:

- Opportunity cost. As discussed in Chapter 3, an opportunity cost is the price of spending your money on one project or investment rather than another. When your money is “tied up” in an investment, you may miss out on investment opportunities that could have earned you more money.

- Inflation. The basics of inflation are also discussed in Chapter 3. Since most economies continuously experience inflation, the rising level of prices must always be considered when investing. The rate of return on an investment must be at least equal to the inflation rate to maintain purchasing power. If it is less than inflation, an investment may increase in dollar value while decreasing in actual purchasing power.

- Cost of capital. Getting the money you need to pay for a project often incurs costs. If the project is financed through debt (i.e. you borrow the money), then interest payments on that loan must be considered. Similarly, if the project is financed by investors (i.e. partners who have pitched in some money), these investors will expect a certain return on their investment. Thus, both of these financing methods, or ways of gaining capital, will cost you money, which is termed the “cost of capital”. Methods for determining the cost of capital for a project will not be covered in this text as they can be quite complex, extending beyond just interest, and returns to investors.

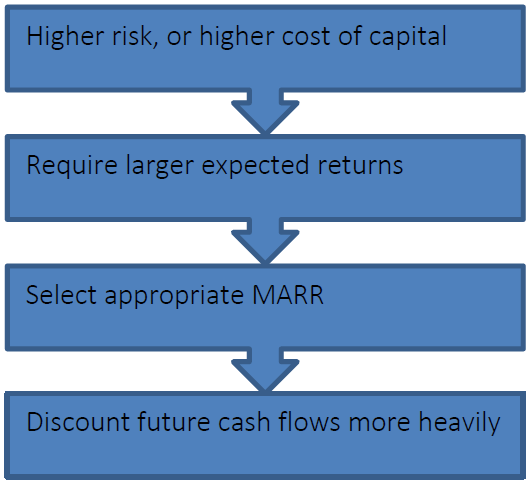

- Risk. The future cash flows of a project are almost never guaranteed or certain. Unforeseen circumstances can alter the amount or timing of expected cash flows; for example, bad weather might delay construction on a project and cause unexpected costs, or a borrower might not repay a loan. The chosen MARR acts as a type of safeguard, ensuring riskier projects are only accepted if they have a higher expected return on investment. For example, investing your money in a small start-up company is generally riskier than investing it in a large, well established corporation because the start-up may be more likely to go out of business; however, the start-up also has the potential to grow at a faster rate, and if its projected MARR is high enough it may be a wiser investment than the corporation. The topic of risk will be discussed in more detail at the end of this chapter.

A reasonable MARR may be determined by considering all these factors (as well as others which may arise). The most important points to remember about the MARR are that:

- it is expressed as a percentage

- it acts as the discount rate for all cash flows associated with the project (the concept of discount rate is discussed in Chapter 3)

Applying the MARR as a discount rate allows you to make an estimate of the present value of a project’s cash flows which accounts for opportunity costs, the cost of capital, and other important factors. Setting an appropriate MARR is a key step in evaluating investment opportunities and ultimately making smart financial decisions.