4.1 Loans

Loans can have many conditions associated with them, which can vary from loan to loan. For example, some maybe simple such as a one month loan from a friend, some are more complex, such as a long-term loan from a financial institution to build a factory. Because loans can be so diverse, categories have been developed to help communicate some of the conditions of the loan. We will first introduce the most common conditions of loans and then explain how they are categorized based on these conditions.

4.1.1 Conditions of the loan

There are several details (i.e. conditions) that may vary or be negotiated between the borrower and the lender. These are generally agreed to and defined in a contract before money changes hands. The most common conditions include the:

- Principal: The amount of money lent/borrowed.

- Amortization period: The total length of time over which the borrower is expected to repay the loan.

- Interest rate: The cost of borrowing money expressed as a percent over a time period. (Refer to Chapter 3 Section 3.2 for more detail). When the interest rate is stated annually, it is called an annual percentage rate (APR) or nominal interest rate.

- Compounding frequency: This defines how often interest is calculated for a loan. It is usually expressed as the number of compounding periods per year.

- Payment frequency: This defines how often payments are made. E.g. weekly, monthly, annually.

- Term of the loan: The length of time the loan contract is in effect. This can be shorter than the amortization period. In such cases, a new loan contract is negotiated at the end of the term, unless the remaining principal is repaid.

- Collateral: This is an asset that belongs to the borrower that the lender can take if the borrower does not repay the loan. Thus, we say collateral is pledged as security on the loan.

All of these conditions are specified in the loan contract. For example, a company decides to borrow $300,000 to purchase new equipment. The loan contract states 4% APR for 5 years, compounded semi-annually with monthly payments. So, the principal is to be repaid over a 5-year period. To get the loan the company pledged a storage facility they own as security.

Here, the principal is $300,000. The amortization period is 5 years. The interest rate is 4%. The term of the loan is 5 years. The compounding frequency is semi-annual, or 2 times per year. The payment frequency is monthly, or 12 times per year. Storage facility is used as collateral.

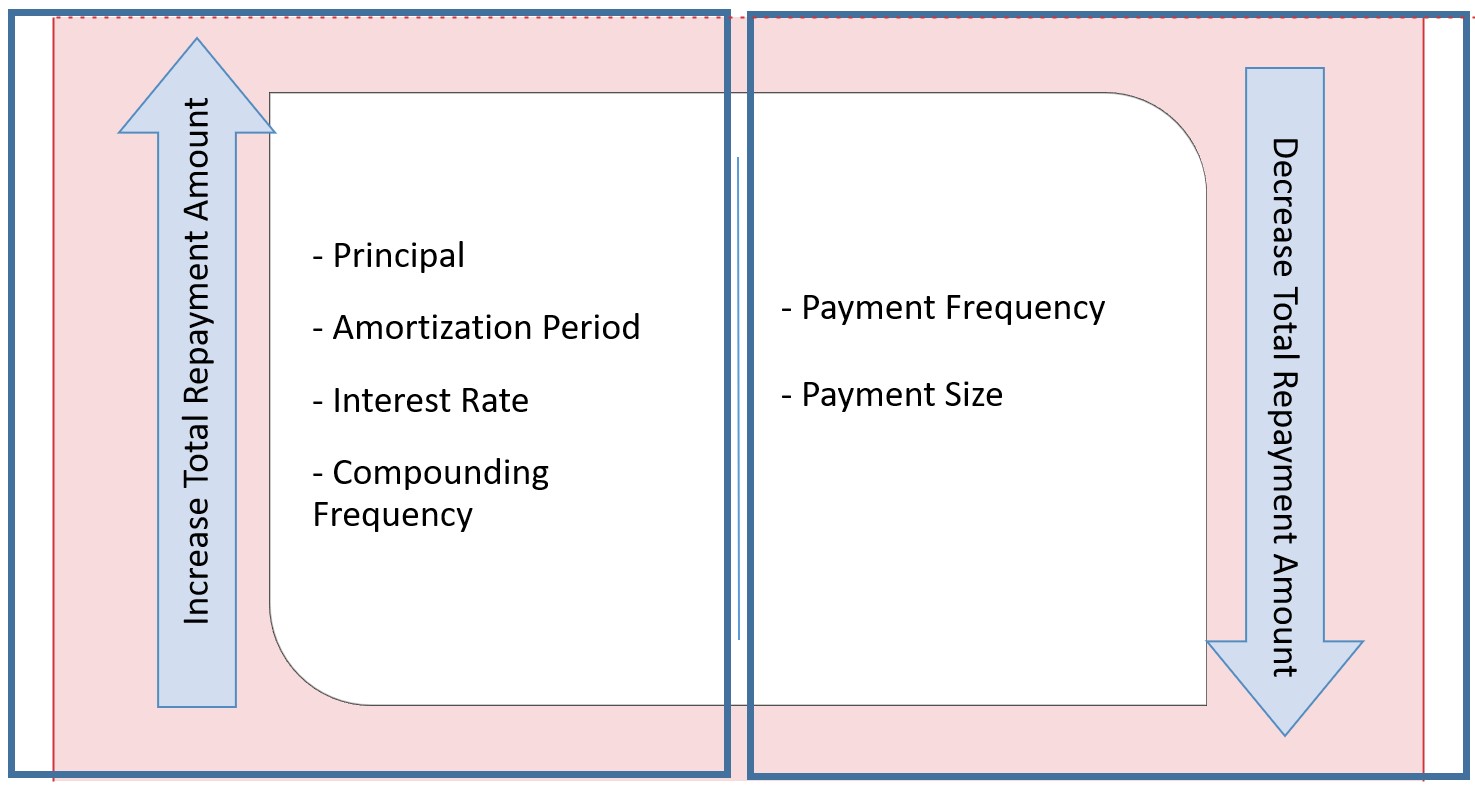

Some of these conditions determine the size of the loan payments and how much interest will need to be paid over the term of the loan, therefore affecting the total amount of money the borrower must repay. This is illustrated in Figure 4.1 below

Figure 4.1. The Relationship Between Some of the Loan Conditions and Total Repayment Amount

As noted in the Figure 4.1, principal, amortization period, interest rate and compounding frequency positively correlate with the total amount of money the borrower must repay. The larger the principal, the more interest the borrower must pay, generally through higher loan payments. Longer amortization periods allow more time for interest to be applied to the balance of the loan, meaning that total interest increases with term length. The higher the nominal interest rate, the larger the interest amount will be accumulated throughout the term of the loan. Increasing compounding frequency increases the total amount of interest to be paid. (We will discuss the mechanism behind the effect of compounding frequency on the loan in section 4.2.1.) Payment frequency and payment size are negatively correlated with the total repayment amount. The more often payments are made and the bigger they are, the faster the loan is paid off, and the less interest is accumulated on the loan.

4.1.2 Type of Loan

Types of loans are basic loan categories that have similar conditions. Knowing and understanding the implications of different types of loans is important in analyzing possible financial scenarios. It is important to be able to distinguish between them and be able to identify their main attributes.

This section will discuss the most common types of loans:

- Amortized loans

- Conventional loans

- High-rate loans

- Collateral loans

- Fixed-rate loans

- Variable-rate loans

- Open loans

- Closed loans

- Interest-only loans

We will also discuss leases because they are a common alternative to loans. For example business owners may choose to lease office space rather than buying an office building.

All of these options can have their own benefits and drawbacks depending on the situation. By understanding how these types differ in terms of loan conditions, we can assess these advantages and disadvantages.

4.1.2.1 Amortized Loans

Amortized loans are the most common type of loans in Canada. In amortized loans the borrower repays the lender by making repeated, typically equal, payments at regular intervals, e.g. monthly, until the loan is repaid. Thus, this is called an amortized loan, because a total period of time for loan repayment (amortization period) was agreed to in advance, and affects other conditions of the loan, including the size and frequency of the loan payments. Each payment is uniform and includes some money to pay interest and some to repay the principal. Payments are made until the loan is repaid in full. Amortized loan calculations will be covered in Section 4.2.

Often, down payments are required by the lender. A down payment is the amount that the borrower must pay upfront to secure the loan or mortgage. For example, to get a $400 000 loan, the borrower might have to pay a 10% down payment, which would be $40,000 in this case (10% of the $400 000 principal). Down payments reduce the risk to the lender.

Amortized loans are often described based on three different characteristics: 1) the amount of the down payment, 2) the interest rate and 3) repayment restrictions. For example, you may hear someone refer to a conventional fixed-rate closed loan. So, what does this mean? We will explain this terminology (as well as the alternatives) below.

First, a loan can be conventional, high-rate or collateral. These types reflect the amount of risk for the lender. To reduce their risk, lenders may require collateral. Often, the collateral is the asset being acquired through the loan (e.g. what the borrower is trying to buy).

For example, say a business decides to purchase an office building, that is worth $1 million. If they borrow $1 million and use the building as collateral, the lender can take the building. Suppose the company is unable to repay the loan. If the bank sells the collateral for $1 million, they can get all their money back. However, they may not be able to sell it for $1 million. If they get less than $1 million, say $900,000, they will lose money on the loan. If the lender tells the borrower that they need to give them a 10% down payment, that is $100,000, they would get all of their money back even if they were able to only sell the building for $900,000. Thus, requiring a higher down payment reduces the lender’s risk of loosing money.

Instead of a down payment, let’s say the lender required that the borrower used a more expansive building that they already own (say $1.5 million) as collateral. Now if the lender doesn’t repay the $1 million loan, the lender can take the more expansive building and sell it to get their money back. Even if they can’t sell it for the initial value of $1.5 million or they sell it at a discount rate to sell it faster (say they sold it for $1.3 million), they still get all their money back.

These examples comprise the three categories below:

- Conventional loans: When the loan amount is less than or equal to 80% of the value of the asset. Typically, this is achieved by making a down payment of at least 20% of the asset’s value (purchase price).

- High-rate loans: When the amount borrowed is greater than 80% of the value of the asset. In these cases, the interest rate is usually higher due to the increased risk to the lender, as discussed above.

- Collateral loans: When another asset (not the one being purchased) is used as a collateral in the loan agreement.

Depending on the interest rate loans can be:

- Fixed-rate loans: The interest rate remains constant throughout the term of the loan.

- Variable-rate loans: The interest rate can fluctuate over time. It is often set in relation to a “prime rate”. In Canada, this is often the Bank of Canada’s prime rate, which is set by the government and reflects the lending rate between banks.

Additionally, loans differ depending on the repayment restrictions, that is the ability to make payments in addition to the agreed repayment schedule.

- Open loans: Allow the borrower to make additional payments on the principal without penalty. This enables the borrower to finish off paying off the loan early and thereby reducing the total amount of interest paid.

- Closed loans: Charge the borrower a penalty if the borrower decides to make any additional payments towards the loan during the term. Historically, in Canada any extra payments were penalised, however in the recent years, these loans have permitted more flexibility, although the amount and type of additional payments may still be restricted. (Why do banks penalize for repaying the debt early?)

Since, as mentioned above, amortized loan payments include some money to pay interest and some to repay the principal. As the borrower makes payments they reduce the amount that they owe, thus they typically build equity (refer to Chapter 1). Essentially, this is how much of the asset purchased through an amortized loan the borrower has paid off and owns now. Think of it this way, if you buy a house with a 10% down payment, you “own” 10% of the house, while the lender “owns” the other 90%. As you make payments towards the loan, the proportion of the house that you “own” increases.

Mortgage

A special case of an amortized loan is a mortgage, which is typically used to buy houses, land and/or buildings. For example, many people apply for mortgages to buy houses. Companies can get mortgages to purchase new facilities to increase production. The difference between mortgages and other amortize loans is that many other loans are unsecured, in contrast, mortgages require the property that is being purchased to be used as collateral, i.e. the owner cannot sell the property without fully repaying the mortgage. Another difference is that for many mortgages the term is substantially shorter than the amortization period, which means a loan agreement is renegotiated multiple times before the loan is fully repaid.

Some features of mortgages are the same as those of amortized loans. Like any amortized loan, mortgages allow the borrower (mortgagee) to buy expensive assets earlier (i.e. without having to save up the full purchase price in advance). And, as with other amortized loans, mortgages generally involve borrowing a lump sum of money upfront and paying it back with regular payments.

A summary of the key differences includes:

- The term is typically shorter than the amortization period

- Mortgages are for real estate

- Properties are typically held as collateral

- There are specific laws surrounding mortgage agreements in Canada

- Interest is typically compounded on a semi-annual basis

- The maximum amortization period for housing

- Down payment requirements, insurance for housing

4.1.2.2 Interest-only Loans

Although uncommon in Canada, another type of loan offered is the interest-only loan. Like amortized loans, interest-only loans involve regular, equal payments made to the lender. In an interest-only loan, however, payments do not affect the principal at all. All payments made are only paying interest on the loan. When the term of the loan ends, the loan will have to be either paid off, or a new loan obtained. Interest-only loans typically require collateral.

An advantage of interest-only loans is that during the term the borrower makes smaller payments, since none of the principal is being repaid. Small payments may be beneficial to borrowers in some scenarios, such as when the income or revenue is currently low but certain to increase in the future. For example, if a company is expanding its production to meet rising demand, and needs money to increase production, an interest-only loan would allow them to keep payments low in the short-term, so they can dedicate as much money as possible towards production. As their sales (and ideally profits) are realized from the increased production capacity, the company will be in a better position to repay the principal.

One drawback of interest-only loans is that the borrower pays more interest for 2 reasons. 1) Typically, interest only loans have higher interest rates than the amortized loans. 2) Interest is calculated on the principal amount for the entire duration of the loan. Another drawback is that since the payments are made only towards interest, the borrower is not building equity on the asset.

4.1.2.3 Leases

Instead of getting a loan to finance purchase, another option may be to lease the item. The concept of a leasing is very similar to renting, except that a leasing agreement is usually for longer periods of time. For example, instead of a month-to-month rental agreement, a lease may last several years. Owners take into account several factors when determining how much they will charge the user(lessee) to lease the item. These can include the initial purchase price of the item, ongoing costs (e.g. maintenance, utilities), and the anticipated resale value.

For the most part, you can think of leasing as long-term renting. Periodic payments are made in exchange for being able to use the asset without buying it. After the lease agreement expires, the asset or equipment is returned to the owner and no more payments are made. Some lease agreements, however, give the lessee the option of buying the asset after the lease expires (typically for a predetermined amount). Car leases, for example, often contain the option of purchasing the vehicle after the leasing agreement is over.

For the lessee, some of the key advantages of leases are:

- Low initial cost compared to loans – no down payment, usually just the first lease payment and administrative fees.

- Known, fixed payments for the entire period of the lease.

- Fewer ownership responsibilities or costs (e.g. repairs and property taxes).

- Avoid the burden of selling (or disposing of) the asset when it is no longer needed.

- Leases allow you to “try before you buy”, so you can make sure the lease item will suit your need before making a substantial investment to purchase the item.

Some of the key disadvantages of leases for the lessee are:

- Restrictions on use and ability to make modifications. E.g. number of hours or kilometers of use, extent of renovations.

- Lessee does not build equity on the asset.

- Potentially more expensive long term.

There are situations where leasing is the best option. In particular, leases may be beneficial to the lessee when the equipment is only needed for a short period of time, or the lessee does not have the expertise in using or maintaining specialized equipment.