2.4 Tax and Depreciation

In this section, we will explore the topics of income tax and depreciation. They both play important roles in financial decision making and reporting, and it is important to understand how the two are calculated and how they are related to a company’s performance.

2.4.1 Income Tax

Income tax is the amount of money remitted to the government, which is usually a percentage of a company’s income. This percentage is called the tax rate and is set by the government.

In Canada, companies are taxed on the federal and provincial levels. Tax rates depend on company’s income.

- On the federal level, there are two tax rates: the general tax rate, 15%, and small business tax rate, which is 10.5%. The small business tax rate is applicable when a company’s income is less than $500,000, which is also referred to as the business limit. That is, if a company generated income lower than the $500,000 income threshold, then the company has to remit 10.5% of it’s income in taxes. If more than $500,000 was generated in income for the tax year, then the company will have t remit 15% of its income to the government.

- On the provincial or territorial level, the two tax rates are – a lower rate and a higher rate. The lower rate applies to small business with income less than $500,000. The higher rate applies to all other businesses. For example, in Saskatoon, small business has to remit 2% of its income in taxes, while businesses that earned more than $500,000 have to pay 12%.

Note that these tax rates are for 2017 and may be changed by the government for subsequent years.

The tax is calculated on the income tax return, which is based on the information from financial statements and is submitted to the government on the yearly basis. In Canada, income taxes are paid by corporations. A corporation is a business owned by one or more owners. The owners are known as shareholders. A shareholder owns shares of the corporation. Shares are units of ownership in a corporation. For example, if a corporation has 1,000 shares, there may be three shareholders who own 700 shares, 200 shares, and 100 shares respectively. The number of shares held by a shareholder represents how much of the corporation they own. The first shareholder who owns 700 shares owns 70% of the corporation (700/1,000 = 70%).

Note that proprietorships and partnerships are not taxed the same way as corporations are. A proprietorship is a business owned by one person. It is not a separate legal entity, which means that the business and the owner are considered to be the same. For example, the profits of a proprietorship are reported on the owner’s personal income tax return, so they are taxed as income of the person using tax rates determined for personal income taxes. A partnership is a business owned by two or more individuals. Like the proprietorship, it is not a separate legal entity and the partners need to report their respective profits on their personal income tax return. Unlike the proprietorship and partnership, a corporation is a separate legal entity. This means, for example, that from an income tax perspective, a corporation files its own tax return (Annand, 2016).

In Canada, all resident corporations (except tax-exempt Crown corporations, Hutterite colonies and registered charities) have to file a corporation income tax return every year even if there is no tax payable. This includes: non-profit organizations; tax-exempt corporations; and inactive corporations. A non-resident corporation has to file a return if, at any time in the year, one of the following situations applies: it carried on business in Canada; it had a taxable capital gain; or it disposed of taxable Canadian property.

Tax is calculated on the income reported on the company’s income statement, which is recorded as income before tax, which we have already mentioned in section 2.1. Recall that to calculate the income before tax, we must subtract production cost, operating and non-operating expenses. These are also called tax deductions, as they reduce taxable income. A company may also be eligible for tax credits, which reduce a company’s tax amount. Notice the difference: tax deductions reduce the income before tax, while tax credits reduce taxes payable. For example, a tax credit of $1,000 reduced taxes owed by $1,000, regardless of the tax rate. A tax credit may be granted in recognition of taxes already paid, as a subsidy, or to encourage investment or other behaviors. For example, a city may offer a local business up to $1 000 tax credit for the installation of energy saving windows on their properties.

Once income tax is calculated based on the income before taxes reported by the company, it is then subtracted from the income before taxes to obtain company’s net income for the period.

For more information on corporation’s income tax you can refer to the income tax guide published by the Canada Revenue Agency (a Canadian federal agency that administers tax laws in Canada), https://www.canada.ca/content/dam/cra-arc/migration/cra-arc/E/pub/tg/t4012/t4012-16e.pdf.

Let’s go back to Canadian Tire income statement. Income tax expense is determined by multiplying a businesses income before taxes by its tax rate. We can determine Canadian Tire’s tax rate by dividing its income tax expense by its income before taxes to determine a tax rate. So, Canadian Tire has paid $265.4/$1001.3 = 0.265 or 26.5% in 2015 fiscal year. That is, the company paid 15% in federal taxes and 11.5% in provincial taxes.

2.4.2 Depreciation

As we already know, a company can deduct operating costs from operating revenues before calculating its taxes payable. There is a particular kind of operating cost that needs to be handled carefully, and that is the operating cost associated with equipment lasting longer than a year. For example, in calculating the operating costs for a photocopy shop, the paper that needs to be purchased every week is clearly an operating cost. But the shop may also need to buy a new photocopier every five years. How is this cost handled?

Here, five years is the economic life of a photocopier. Economic life, which is usually expressed as a number of years, is the total time that the asset is used by the business to generate income. It is also the period over which depreciation is charged. Depreciation is the reduction in the value of an asset. The potential causes for depreciation of an asset include

- physical depreciation, or wearing out;

- functional depreciation, as when the function an asset provides becomes inadequate or unneeded;

- technological depreciation, where other means of performing the same function better or more cheaply become available;

- depletion, as in the consumption of a non-renewable natural resource; and

- monetary depreciation, that is, the need to set aside additional money to replace an asset because inflation has pushed up the price of a replacement.

A photocopier might need to be replaced every 5 years because of physical and technological depreciation. Here, these are the primary reasons photocopier as an asset loses its value. In other words, you can think of this as company using up a part of an asset to produce revenues. From previous example, this would be equivalent to saying that a company “uses up” a photocopier throughout 5 years. After the economic life of an asset is over, the photocopier will be “used up” in production, and its book value will be equal to 0.

Now that we know what depreciation is, how do we approach the its calculations? There are three methods of calculating depreciation that will result in extinguishing the book value of the asset when its estimated useful life ends: the straight-line method, the declining balance method, and the activity-based depreciation method.

Straight-Line Method

The straight-line method reduces the book value of an asset by the same amount each period. This amount is determined by dividing the total value of the asset, less its salvage value, by the number of periods in its useful life. This amount is then deducted from income in each applicable period. Straight-line depreciation is the simplest and most-often-used technique. The depreciation amount for the period is calculated as follows:

ADD EQN (2.24)

For example, say a photocopier costs $6000. The economic life of a photocopier is 5 years. The residual value of a photocopier after 5 years will be $1000. Then, using formula 2.10, the yearly depreciation expense is: ($6000-$1000)/5=$1000. This means that every year for 5 years (from the moment of purchase until the photocopier is disposed) the company can record depreciation expense of $1000 as part of its production costs. So, the depreciation schedule is as follows:

| Year | 1 | 2 | 3 | 4 | 5 |

| Depreciation | $1000 | $1000 | $1000 | $1000 | $1000 |

| Remaining Balance | $5000 | $4000 | $3000 | $2000 | $1000 |

Table 2.1 Straight-Line Depreciation Schedule

The last row of the table above shows the remaining balance of an asset, which is the remaining value of an asset after deducting depreciation for the period. It is calculated by subtracting depreciation from the value of an asset at the beginning of the period. To get the remaining balance in the first year we subtracted $6000-$1000=$5000. In the second year, the remaining balance is the value of the asset at the beginning of the period minus depreciation $5000-$1000 = $4000. The remaining value of an asset in the straight-line depreciation method is the residual (or salvage) value.

Declining Balance Method

The declining balance method of depreciation provides for a higher depreciation expense in the first year of an asset’s life and gradually decreases expenses in subsequent years. This may be a more realistic reflection of the actual expected benefit from the use of the asset because many assets are most useful when they are new. Under this method, the annual depreciation expense is found by multiplying the residual value of the asset each year by a fixed rate. Since this remaining value will differ from year to year, the annual depreciation expense will differ as well, unlike in the straight -line method. Since the declining balance method will never fully amortize the original cost of the asset, the salvage value is not considered in determining the annual depreciation.

Annual depreciation expense using declining balance method is calculated as:

![]() (2.25)

(2.25)

Let’s calculate depreciation schedule for the same photocopier now using the declining balance method with the depreciation rate being 35%.

For the first year, the depreciation is:

$6000*0.35=$2100

The remaining balance after first year is thus:

$6000-$2100=$3900

Continuing to the second year, the depreciation is:

$3900*0.35=$1365

And the remaining balance is:

$3900-$1365=$2535

We continue these calculations for 5 years to get the depreciation schedule below:

| Year | 1 | 2 | 3 | 4 | 5 |

| Depreciation | $2100 | $1365 | $887.25 | $552 | $383.51 |

| Remaining Balance | $3900 | $2535 | $1647.75 | $1095.75 | $712.24 |

Table 2.2 Declining Balance Depreciation Schedule

Here, we see that at the end of 5 years the remaining value of the photocopier is $712.24. This means, that the company wrote off $5287.76 in depreciation expense over 5 years with depreciation rate equal to 35%. (To compare, the company wrote off $5000 using single-line depreciation method).

Activity Based Depreciation Method

This method is less common compared to the single-line and declining balance depreciation methods in Canada. Activity based depreciation method is not based on time, but on a level of activity. That is, when the asset is acquired, its life is estimated in terms of its activity level. This could be miles driven for a vehicle or a cycle count for a machine. Using this method, the depreciation is calculated by multiplying the activity depreciation rate by the activity level of the asset:

![]() (2.26)

(2.26)

For example, a company that uses a depreciation rate of $0.2/km for its vehicles would have a depreciation expense of $100 after 500 km. If the vehicle drove 100,000 km in one year, the depreciation for the year would be 100,000km * $2/km= $20,000. The remaining balance of the asset in the period is calculated as usual by subtracting depreciation from the value of an asset at the beginning of the period.

Effect of Depreciation on Taxes

Depreciation is part of production expense and can, therefore, be deducted together with other production costs when calculating income before taxes. In general, the allowable annual depreciation deduction is fixed by the income tax laws. In Canada asset depreciation follows Capital Cost Allowance (CCA) regulations.

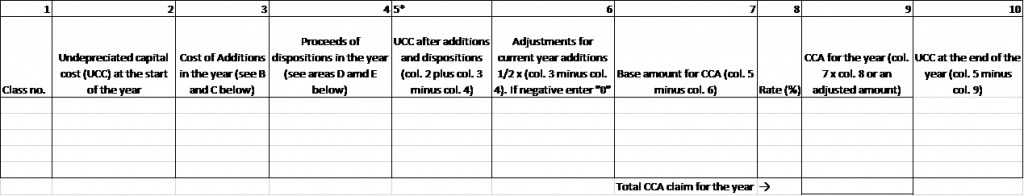

CCA is the only allowable depreciation expense in Canada. The CRA provides a classification of different types of assets, and a CCA rate and depreciation method for each class of assets. In filling in the tax return, each class must be accounted for separately, as follows:

- Start with the undepreciated cost of all assets in that class at the beginning of the year.

- Subtract the proceeds from the sale of any assets in that class that you’ve disposed of during the year.

- Add the total allowable cost of asset additions during the year. (This is only 50% of the cost of the assets you’ve actually purchased during the year; the other 50% is shifted forwards to next year.)

- Subtract any government assistance payments or investment tax credits. The resulting figure is the undepreciated capital cost (UCC) to be used in tax calculations.

- Apply the appropriate CCA rate. (To find the appropriate rate, check with the most recent publications of Revenue Canada, or consult a tax lawyer.)

To determine which class an asset falls in, please refer to the classifications found on Canada Revenue Agency’s “Classes of depreciable property” on their website at: http://www.cra-arc.gc.ca/tx/bsnss/tpcs/slprtnr/rprtng/cptl/dprcbl-eng.html. Note that CCA rates vary from 4% all the way up to 100%.

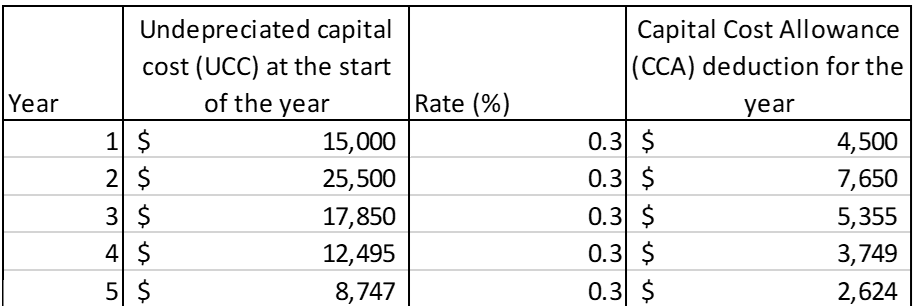

Let’s look into how the CCA is calculated in more detail. Suppose, a company purchased a $30,00 work vehicle and wants to calculate the CCA deductions for the vehicle. When an capital asset is purchased during a company’s fiscal year it can begin being depreciated. As we already mentioned above, to determine the amount of the CCA deduction you begin with the assets Undepreciated Capital Cost.

Partially for simplicity in accounting, and partially to account for the different times during a fiscal year an asset can be purchased, the Canada Revenue Agency uses the half-year rule. This rule states that during the fiscal year the asset is purchased only half of the initial cost can be used in the CCA calculation. For example, a $30 000 work vehicle would have an initial UCC of:

![]() (2.27)

(2.27)

![]()

This value is then multiplied by its appropriate CCA rate to determine the deductible depreciation expense for the year. Motor vehicles fall under “Class 10.1” which has a CCA rate of 30%. The CCA deduction for this year is, thus, calculated as:

![]() (2.28)

(2.28)

![]()

This $4,500 would lower the company’s taxable income and, ultimately, its total income tax expense.

Year by year, assets will continue to be depreciated and depreciation expenses will continue to be deducted from income tax determined by each years UCC. With the CCA expense calculated, we can determine the UCC for the following year. After the first year, the half year rules ceases and the full UCC (or the total initial cost), minus the CCA deduction from the previous year, is used to determine the CCA deduction.

The company’s UCC for year 2, in relation to the work vehicle, for the following year would be calculated as following:

![]() (2.29)

(2.29)

![]()

![]()

The company’s CCA deduction for year 2 would be calculated as follows:

![]()

![]()

Note that the CCA Deduction for year 2 is larger than year 1. This is because of the affects of the half year rule reducing the amount deductible in the year the asset was purchased. From this point on, the CCA deduction would be reduced due to the UCC continually becoming smaller with each year. The CCA Deduction for a specific year can be generally calculated as:

![]() (2.30)

(2.30)

Businesses usually have more than one asset, and quite often purchase new assets and sell, or dispose, of old assets. As a result, the CCA deduction is determined by the sum of each assets CCA deductions. Furthermore, acquisitions of new assets are added at the half year rule and the disposition of assets reduces the CCA deduction by its selling price. The Canada Revenue Agency provides form T777: Statement of Employment Expenses for individuals and T2125 Statement of Business or Professional Activities to calculate and report CCA deductions for the year. The following is an excerpt from T2125 Statement of Business or Professional Activities:

*Note: this excerpt does not include all the information necessary to record CCA tax expenses; it is the cumulative section which is used to calculate the CCA Deduction and the UCC*

(T2125 Statement of Business or Professional Activities, 2016)

Let’s continue the truck example to illustrate how the company would depreciate the truck it purchased over the first five years:

Table 2.3 Vehicle Depreciation

Once an asset has meet the end of its useful, or is otherwise sold, the proceeds from the disposition of that asset are then deducted from the total value reported for asset acquisitions for that year. If the company was to sell the truck and buy a new work vehicle, the proceeds from the first truck’s sale would be subtracted from the purchase cost of the second truck when determining the total UCC for the year.

Supplementary Material

- For more information on Canadian taxation go to CRA webpage https://www.canada.ca/en/services/taxes/income-tax/corporation-income-tax.html

Discussion and Review Questions

- What is the purpose of an income statement, balance sheet and cash flow statement and what information do these financial statements contain?

- What are financial ratios?

- What are the categories of financial ratios and what does each category analyse?

- What are pro forma financial statements and how are they used in forecasting?

- What is income tax and how is it calculated in Canada?

- What is depreciation and what methods are used to calculate it? How is it recorded in Canada?